Opportunity and vision of BV

With unique solutions and a focus on sustainable growth, we are putting our future vision into action. What you can anticipate from us over the next five years is listed below;

Our strategy

BV has continued to advance important strategic plans despite the obstacles posed by 2020, which include the unprecedented effects of the global epidemic and mass market sales earlier this year.

Customers should receive the best investment options.

By the end of 2021, 71% of our fixed income assets and 68% of our active assets have provided the most effective services.

Keep up solid incremental margins

We have been able to significantly raise our adjusted performance rate since 2021, which has increased our adjusted earnings per unit by 20% annually, by diligently managing our costs while expanding the business.

Create, market, and expand differentiated services

Our equitable equity services have continued to experience significant organic growth, and we have achieved commercial success on both mature and emerging platforms across all business channels.

Investment opportunity with BV

Financial advisors occasionally consult personal reviews to learn the specifics of what prompts comments. The three most popular tests are the Myers-Briggs, Kolbe, and DISC. However, one of the difficulties of this test is that they require a mentor to help them learn more before they can be of assistance. The Myers-Briggs model, for instance, identifies 16 different personality types. There is a lot to keep in mind.

Fortunately, you can enhance your client interactions without having a psychology degree. Utilize this straightforward model to negotiate interactions with the four fundamental personality types.

Applying the Model: Four Types of Clients

Now let’s consider the types of clients you meet based on this field.

Managers

On the far right of the spectrum, need to control everything. They usually use artificial intelligence when it comes to investing, but sometimes they hire a consultant to provide them with information and access to information or to handle unpleasant, complex tasks. Managers are hard to work with, as they want to control every decision and every aspect of the relationship.

The editors

In the middle, want to control something. Less likely than Dominators to seek to deal with their own investments and usually hire an adviser; however, Participants are not willing to release the investment process entirely. Instead, they want to be involved in all decisions and need to understand the proposals before agreeing on a procedure. A client with this type of personality is not comfortable giving wisdom to its counselor; you need constant discussions about decisions and you want to understand market dynamics. Self-proclaimed mentors or mentors often enjoy working with these clients.

Actors

Feel like they have no control over events in their lives and often need significant support. Common factors include helplessness and feeling overwhelmed by life's problems and wealth management. Characters do not usually create wealth; generally, they receive family income as an inheritance.

Posters

Do not need much control but are still frustrated by unexpected events and react strongly when they feel betrayed or mistreated. Therefore, it is important to build and maintain trust by delivering a consistent experience of interest and expertise. For details on how to do this, see the white paper of the Vantagecapitalinvestment Advisor Institute inside the Mind of the Uniquely Successful Investor.

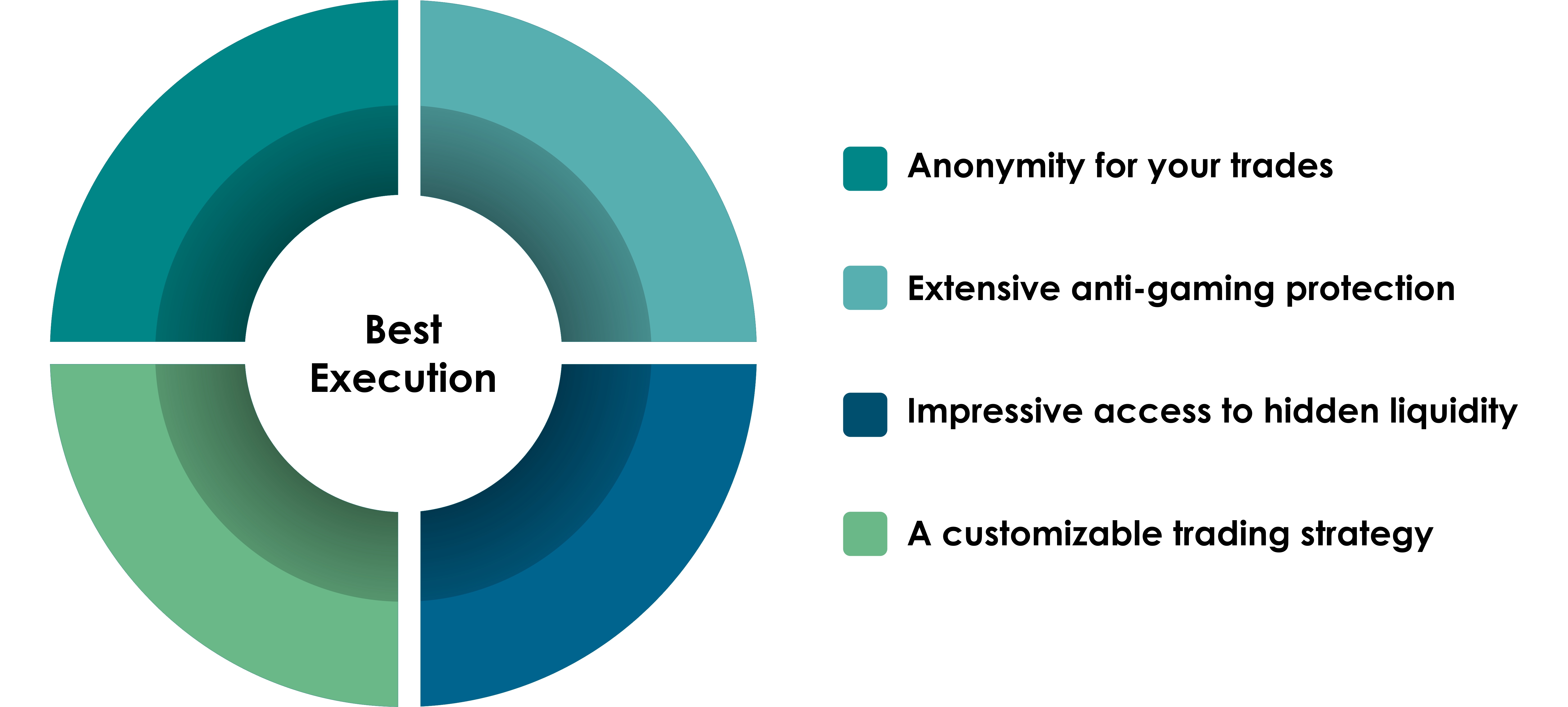

Vantagecapitalinvestment TRADING

At the heart of every choice we make is ensuring the satisfaction of our clients.

Portfolio management

Planning and implementing cash flows, estimates, and transitions are helped by our skilled international portfolio trading team. By balancing globalization, our trading platform is beneficial.

Derivatives

The Equity Derivatives team at Vantagecapitalinvestment works with clients to help them maximize performance while lowering risk. The team uses stock options, ETFs, and international indicators to offer clients top-notch exit strategies.

Trading solutions using algorithms

Our extensive selection of cutting-edge internal layout solutions and algorithms can be tailored to suit specific requirements. The BV Execution Research team offers suggestions, analysis, and solutions in order to increase client profits.

Trading with high touch

The Vantagecapitalinvestment high-quality sales team generates income naturally by selling to our institutional customers around the world. Orders are handled with the same care and diligence as a side buyer who manages his orders because they are a devoted partner to our customers. In order to provide succinctly focused content that affects trading decisions, our High-Touch Trader Team collaborates closely with our Sector Professionals and the research team mentioned above.

Trade fixed income

The biggest hedge funds and asset management accounts in the world are among the many accounts with which we have connections. We can offer our customers the best revenue and performance thanks to this network. With a focus on illegal and inferior tools, we specialize in securities issued by financial services companies, emerging market banks, and specialized conditions.

Services for trading strategies

Customers can receive individualized assistance from the Vantagecapitalinvestment Portfolio Trading Strategy team with portfolio design, transformation, and ongoing risk assessment. The team creates portfolio creation, risk analysis, and historical trading analysis tools for the Vantagecapitalinvestment Cube app. Events involving liquidity and significant market indicators are also examined.